With Connecticut already losing businesses, jobs, and economic standing thanks to Failed Governor Dan Malloy’s tax-and-spend agenda, new federal tax hike proposals by Washington D.C. Democrats are raising even more questions for their party’s gubernatorial candidates. Last week, Democrats in Congress put forward a comprehensive tax hike plan, pledging to increase income taxes, business taxes, and the death tax, should they secure majorities in Congress this fall.

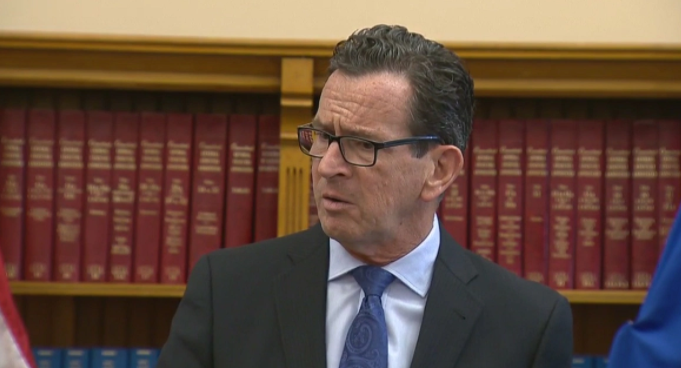

Connecticut taxpayers are all too familiar with tax increases like these, having spent over seven years watching Dan Malloy drive their state into fiscal chaos and economic decline using similar proposals. But this raises even more questions for Democrats running for Governor in Connecticut like Ned Lamont, Susan Bysiewicz, and Luke Bronin. All have stood silently by for years as Dan Malloy has taxed the state into decline, and some, like Lamont, have enthusiastically endorsed his newest tax and fee hikes this year. But none of them have publicly expressed their support or opposition to Democrats seeking to impose Malloy-style tax hikes on a federal level.

After watching Malloy and his enablers drive Connecticut’s economy into decline using anti-business, anti-jobs tax hikes, voters deserve to know if the Democrats running to lead their state will support congressional Democrats’ efforts to further burden them with new Malloy-style federal tax increases.

Forbes writes:

“This week, Congressional Democrats released a detailed tax hike plan that they promised to implement if given majority control of the House and Senate after the 2018 midterm elections. So much for the crocodile tears about the deficit–Democrats want to raise taxes not to reduce the debt, but rather to spend that tax hike money on boondoggle projects.

Up until this year, the United States labored under the highest corporate income tax rate in the developed world. As a result, jobs and capital were fleeing America for more normal tax rates that could be found in tax havens like France and China (saracasm font very much activated). Finally, after many years of bipartisan consensus that the U.S. corporate rate had become an impediment to attracting new jobs and investment, Congress cut the rate all the way from 35 to 21 percent. Even doing that only puts us in the middle of the pack of developed nations, but that’s a heck of a lot better than dead last.

Instead of figuring out how to raise taxes, Congressional Democrats would do better to work in a bipartisan manner to make the middle class and pro-jobs tax relief just passed into law permanent. A rising tide lifts all boats.”

See the latest videos from RGA

Watch our videosHappy Independence Day!

Always proud to be an American!🇺🇸 https://x.com/GOPGovs/status/1941089615127163218/video/1

I want to congratulate @POTUS, Senators @berniemoreno and @SenJonHusted, and Ohio’s Congressional delegation for today e…

Follow RGA on Twitter

Follow RGA on Facebook