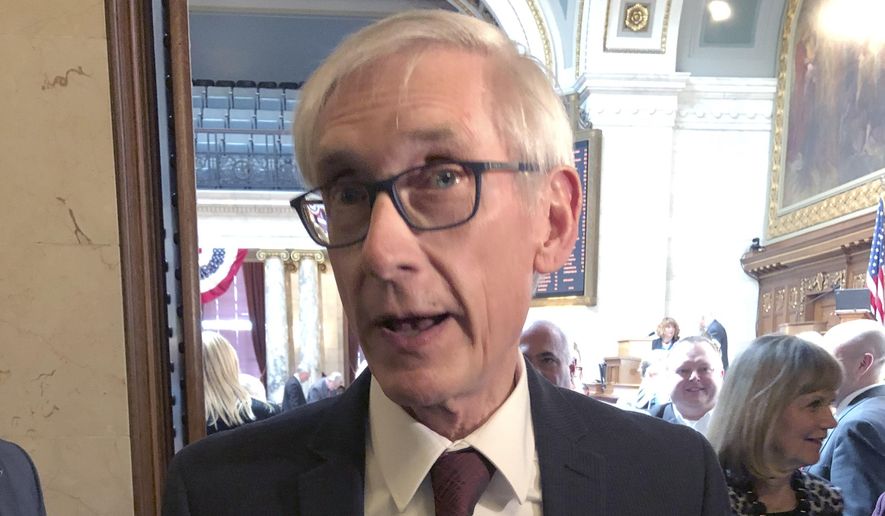

Since taking office, liberal Wisconsin Governor Tony Evers has consistently turned his back on the hardworking taxpayers of the Badger State. Despite pledging he wouldn’t raise taxes on the campaign trail, Evers broke his promise almost immediately after taking office by proposing $1.3 billion in tax increases – he even had the audacity to call his billion-dollar tax hike “small.”

Now Evers, an admitted admirer of Democratic presidential frontrunner and avowed socialist Bernie Sanders, is doubling down on his devotion to higher taxes by vetoing a $250 million tax cut that received bipartisan approval in the Wisconsin State Legislature and would have benefitted two million hardworking Wisconsinites.

According to analysis from the Center for Research On the Wisconsin Economy (CROWE), “low-to middle-income taxpayers would benefit the most,” from the tax cut vetoed by Evers, while the Associated Press reported that Wisconsin manufacturers would have seen their taxes decrease by $45 million by exempting machinery and tools from property taxes.

“Barely a year on the job, Tony Evers has already made it abundantly clear that he’s determined to raise taxes on hardworking Wisconsin families and job creators at all cost,” said RGA Communications Director Amelia Chassé Alcivar. “Wisconsinites deserve a governor who will get his hands out of their wallets and focus on growing jobs instead of using the taxpayers as his personal piggy bank.”

See the latest videos from RGA

Watch our videosCrime continues to rise under @BobFergusonAG.

Washington needs a governor who will tackle crime: @reichert4gov!

Conservative leadership is working in Virginia under @GlennYoungkin:

➡️ #1 State for Business

➡️ $5 billion in tax relief

➡️ Record job growth

Follow RGA on Twitter

Follow RGA on Facebook